ZeroHedge is an occasionally-reliable, often-interesting source for news from a vaguely libertarian perspective, in addition to financial news from a vaguely Austrian perspective and breathless reportage that, any day now, the stock market is going to go either down or up unless of course it stays the same, so you should probably buy futures contracts, gold, and bitcoin all at the same time.

Hey, things could be worse. They could start running openly communist claptrap about how capitalism has failed and needs to be replaced with something more "fair."

New Zealand’s new prime minister Jacinda Ardern calls capitalism a blatant failure. Former Greek finance minister Yanis Varoufakis says capitalism is ‘merely’ coming to an end because it is making itself obsolete.

So our "evidence" begins with citations from avowedly-socialist professional economic central planners to the effect that economies require more central planning. It makes one wonder if "Raul Ilargi Meijer" determines whether or not his carpet needs to be cleaned by calling a carpet-cleaning company and asking what they think.

Mathematics professor Bruce Boghosian claims that without redistribution of wealth, our market economy would not be stable, because wealth always tends to concentrate.

Mathematics professor (read: government employee) Bruce Boghosian can claim that if he wants to, but he’s wrong. He is, of course, basing his assertion on Thomas Piketty’s "r > g" trope, which states that, as an economy grows, the share of income accrued to capital increases relative to the share given to labor. The main problem with this is that Piketty falsified the data he used to generate this conclusion. Magness and Murphy:

Whereas other data critiques, including that of the Financial Times, have raised important normative and methodological questions in Piketty’s data presentations, the issues highlighted here suggest an even more fundamental problem of his reliance upon factually mistaken data claims, unsupported assertions of validity, and certain dubious chart constructions that only make sense in service to a preconceived narrative. The discrepancies we identify are pervasive in the book, beginning with misstatements of basic historical fact and extending to an abundance of political distortion and confirmation bias in his data selection and methodological choices.

Seriously, you should read the paper, which comprehensively explodes Piketty and his cheerleaders and their incessant claims of "growing inequality." After clearing out Piketty’s hard-coded "adjustments" to the data, Magness and Murphy found that "the North American ratio hovers around a comparatively stable and flat 4:1 for the entire twentieth century." 4:1, you say? Otherwise known as 80:20? Gosh-all-get-out, whoever would have expected that?

Okay, fine, you don’t want to read a white paper. Listen to the Murphy blow this trumpet instead, then.

So the entire thesis of this commie article is bogus from the get-go. We’re done here, then, right? Right?

At the very least we can say that the system is under pressure. But what system is that? It would be nice to have a clearcut definition of capitalism, but alas, there are many, about as many as there are different forms of it. That doesn’t make this any easier. Americans call many European economies ‘socialist’, which seems to mean they are not capitalist. But Scandinavian countries don’t function like the Soviet Union either.

Wrong. And… wrong. Aces.

Okay, champ. Listen to me slowly. The difference between capitalism and socialism revolves around ownership of the capital stock — what one discredited old drunken German know-nothing used to call "the means of production." Under capitalism, the capital stock is privately owned. Under socialism, it is state-owned (yes, there are socialist strains that try to obscure this by claiming that "workers’ collectives" or labor unions or whatever will own the capital stock, but, in practice, the one and only way to prevent private ownership is through aggressive violence, meaning that the overseer doing the preventing is the state, de facto if not de jure). So, then, what about that there Sweden? Which one is it, hey?

Obviously the correct answer is "neither." All modern nation-states are in reality some type of "mixed economy" — an attempt to blend the prosperity and happiness of capitalist societies with the top-down control and institutionalized evil of socialist societies. As to why they seem to be perpetually in one crisis or another, Ludwig von Mises explained that lucidly almost ninety years ago — so, once again, I’m reduced to telling one or other internet smarty-pants to read a book for a change.

Anyhow, this time we’re done here for sure, right?

So to which extent should a state interfere in markets, and in society at large? There are obviously wide ideological divides when it comes to answering that one. Does that mean there is no answer possible at all? Perhaps not. Perhaps the answer lies in the fact that the system is predestined to fail, as Boghosian’s mathematical models suggest: "Our work refutes the idea that free markets, by virtually leaving people up to their own devices, will be fair.."

Dear professor Bogmonster: next time you find yourself in a life-or-death struggle against a straw man, setting it on fire is way faster than writing a tendentious paper. It also gets you mocked less on the internet.

Interventionism is, of course, predestined to fail. We’ve covered that. But only a lunatic with an axe to grind could possibly elide all the differences — previously recounted in this very article! — between interventionism and actual, for-reals capitalism. So you’re not going to do that, right, Raul?

That doesn’t necessarily demand a lot of interference, we could ‘simply’ write the rules of the game in such a way that the ‘natural tendency’ towards wealth concentration is blocked. An example is the history of the top US income tax rate. Arguably, the nation was doing a lot better under Eisenhower and Kennedy, with a top rate of 91%, than it is today. If you put a few rules like that in play, perhaps including Varoufakis’ idea of a ‘common welfare fund’, maybe the state doesn’t have to interfere much otherwise.

See? The state doesn’t have to interfere much! It just has to confiscate a measly 91% of your income. Barely noticeable!

Setting aside the moral issues involved with putting a gun to somebody’s head and demanding 91% of his money, we have to come face-to-face with two painful truths: first, that the statement "arguably, the nation was doing a lot better" is utterly devoid of meaning, yet constitutes Raul’s entire argument, and, second, that that 91% top tax rate, beloved by knaves and fools everywhere, is a lost little girl stumbling vainly through a dark forest, utterly surrounded by shadowy lurking variables. Stalking variables, just waiting to pounce.

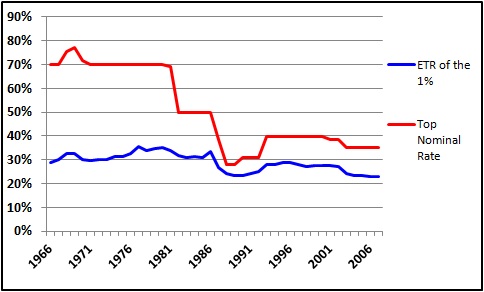

The biggest problem with this bone-brained argument is that nobody paid that much in taxes. Back when the 91% bracket existed, the tax code was filled with loopholes and deductions that absolutely all of the people in said bracket used to get out with most of their money intact. Indeed, eliminating those loopholes and deductions was the other half of the Reagan administration’s reduction in tax rates, to the effect that there was basically no change in the amount of tax paid:

There are, of course, thousands of other government interventions into the economy that would have to be accounted for, including no small number of other taxes, in any analysis of how well or poorly the nation is doing at any given time. Looking at exactly one piece of exactly one intervention and professing to draw meaningful conclusions from it is idiocy of the first order.

One of the main underlying claims of capitalism, and of macroeconomics in general, is that markets — and societies — will sort themselves out if left alone. Bruce Boghosian says this is not true, and that he has the math to prove it. The entire notion of markets tending towards a ‘supply-demand equilibrium’ is nonsense, he says.

Now it’s time for idiocy of the second order. "Capitalism" has apparently become a subset of "macroeconomics" by this point in the article, which is causing me no end of suspicion that Raul just has no idea what the words he’s using even mean. This suspicion is deepened by the rest of the sentence; what would it even mean for markets "– and societies –" to "sort themselves out?"

Of course, that level of stupidity is utterly dwarfed by the following assertion that markets do not trend toward equilibrium. There is, in a very real sense, no possible other thing they could trend toward! Nothing at all! Whatever rest state they reach is, quite by definition, equilibrium. In particular, what it means to speak of supply and demand "equilibrating" is that, in the bidding process on the free market, the desire of sellers to obtain the highest possible price and the desire of buyers to pay the lowest possible price are countervailing forces; the sellers invariably have to lower their prices in order to attract more buyers. Regardless of what government employee Bogbeast wants to pretend, this is obviously and manifestly true; look at literally any Hot New Thing on the market. It’s introduced at a given price, and people buy it. Then, somewhat later, the price is reduced. Why would that be? That’s because everybody (or nearly everybody) who was willing to pay the old price already has all of that thing that he wants. How to sell the remaining stock? Attract more customers. How to do that? It is a mystery!

Short version: seriously, you fools, read a book already!

This refutes much of what our economic systems are based on, which would appear to indicate that we need an urgent revision of these systems. Unless we would agree that Darwin-on-Steroids is a good idea. We don’t and won’t, because it would mean Stephen Foster’s "frail forms fainting at the door" all over the place. A market ideology that causes widespread misery has no future.

[sic]

Okay, guy, never mind a book; just read an essay maybe, for pity’s sake! Reisman:

So far from being a competition whose outcome is "the survival of the fittest," the competition of capitalism is more accurately described as a competition whose outcome is the survival of all, or at least of more and more, for longer and longer and ever better. The only sense in which only the "fittest" survive is that it is the fittest products and fittest methods of production that survive, until replaced by still fitter products and methods of production, with the effects on human survival just described.

As von Mises has also shown, with his development of Ricardo’s law of comparative advantage into the law of association, there is room for all in the competition of capitalism. Even those who are less capable than others in every respect have a place. In fact, in large measure, competition under capitalism, so far from being a matter of conflict among human beings, is a process of organizing that one great system of social cooperation known as the division of labor.

I’m totally serious here: have you ever read anything? It’s like this Raul guy sprang fully-formed from the head of Zeus and started dispensing his "timeless wisdom" completely uninformed by literally thousands of years of superior intellects.

And, by the way, guy, your ideology rocks my socks when it comes to "caus[ing] widespread misery."

Yanis Varoufakis doesn’t so much argue that capitalism has already failed, he says it is bound to fail in the near future. Because new technology, including artificial intelligence, will destroy too many jobs for society to continue to function intact. That is already happening, in that we both produce and consume Google’s ‘products’, but we get none of the profits.

So buy Google stock, you friggin’ weirdo! Problem solved, right?

Though it’s probably worth noting that ex-Valve employee Yanis Varoufakis, dingbat though he may be, didn’t say anything like what crazy Raul extrapolated from him. I mean, what does that even mean? I can go down to Three Bears and buy a standing rib roast and a shotgun (but seriously, I love Three Bears) and "get none of the profits," but I get a standing rib roast and a shotgun, right? Am I missing something here?

Google aims at taking over our entire communities, and claims this will be to our benefit. We let the new technology companies expand far and wide, to a large extent because our ‘leaders’ don’t understand what is happening any better than we do. But that is not a good thing, for many different reasons. It’ll be very hard to whistle them back later, both because of the wealth they’re building, and because of the intensifying links they have to government, including — or especially — the intelligence community.

So that’s why we need more government? So that those "links they have" will be even more impenetrable? Not sure you’ve thought this one out, champ.

Has capitalism failed already, as Jacinda Ardern claims, or will that happen only in the future, as Varoufakis says? It may be a moot question once the system and the markets start collapsing.

You ever try so hard to say something smart that you end up saying something incredibly stupid? Raul’s had that happen.

If the remaining wealth is not divided better than it is today, those who have gathered most of it will also find themselves in non-functioning societies and communities. [Emphasis original, oddly enough]

Here’s a quick trick for determining whether or not you’re a complete moron. If you ever talk about "distribution of wealth," or any other weasely way of saying the same thing, you’re a complete moron. Why? Riddle me this, caped crusader: why was nobody sitting at the computer at 11:30 at night writing blog posts on the internet demolishing some nitwit’s pro-communism screed back in 1954? Was that just because nobody had come along and "distributed" the computers yet? Was all the internet hoarded by the 1% and just waiting for Crusaders of Social Might and Magic Justice to divide it more fairnessly? Obviously not. That wealth didn’t need to be "distributed," it needed to be produced. Production is the key, you clown. Now get your greedy fingers out of the way and let it happen, already.

So in conclusion: shut up, Wesley. The end.